PA State Taxes: Military Guide! Avoid Costly Mistakes

Pennsylvania offers certain tax advantages to active duty military personnel, but understanding the specifics is crucial to avoiding penalties. The Servicemembers Civil Relief Act (SCRA) provides federal protections, influencing how states like PA treat military income. Many find that professional tax advisors specializing in military finances can significantly streamline the filing process. Navigating the nuances of residency requirements is also key to determining whether you do active duty military pay state taxes in pennsylvania. This guide cuts through the complexity, offering clarity for active duty service members.

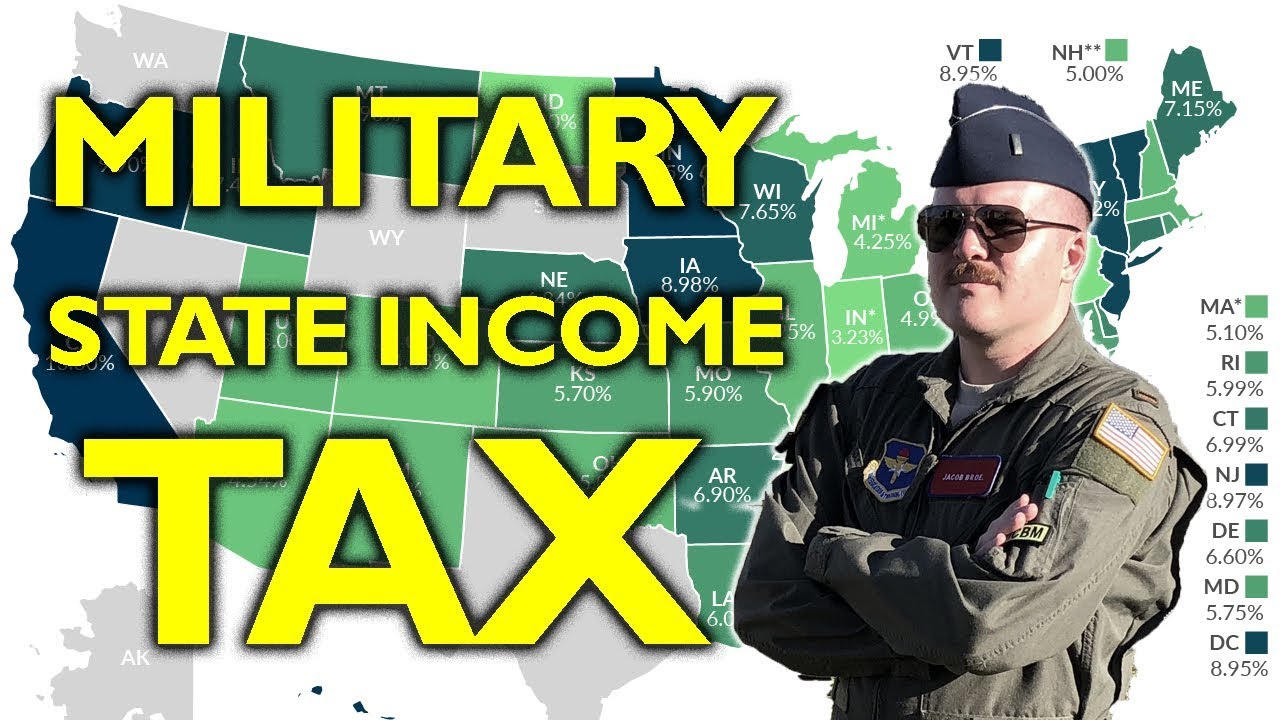

Image taken from the YouTube channel Jake Broe , from the video titled Paying State Income Tax in the Military (or NOT paying) .

Pennsylvania State Taxes: A Military Guide

This guide helps active duty military personnel understand Pennsylvania state tax obligations, specifically addressing whether you need to pay them. Misunderstanding these rules can lead to costly errors, so pay close attention.

Understanding the Core Question: "Do Active Duty Military Pay State Taxes in Pennsylvania?"

The short answer is: it depends. Residency and where you are stationed are the crucial factors.

-

Resident vs. Non-Resident: Pennsylvania taxes its residents, regardless of where they are stationed. However, it provides certain exemptions for active duty military.

-

Key Concept: Legal Residence (Domicile): Your legal residence is where you intend to return when your military service ends. It's typically where you lived when you entered the military and haven’t officially changed.

Determining Your Pennsylvania Residency Status

Establishing Pennsylvania as Your Legal Residence

If Pennsylvania was your home before you joined the military, and you haven't taken steps to establish residency elsewhere, you are likely still a Pennsylvania resident. Factors considered include:

- Holding a Pennsylvania driver's license

- Registering to vote in Pennsylvania

- Owning property in Pennsylvania

- Listing Pennsylvania as your home of record with the military

Establishing Residency Outside of Pennsylvania

You can change your legal residence to a state other than Pennsylvania while serving. Evidence of this includes:

- Obtaining a driver's license in another state

- Registering to vote in another state

- Purchasing a home in another state and claiming it as your primary residence

- Formally declaring residency in another state (where applicable)

Pennsylvania State Tax Obligations for Active Duty Military

This section outlines specific tax rules based on your residency status.

Pennsylvania Resident Active Duty Military

If Pennsylvania is your legal residence:

- Taxable Income: Generally, all of your income, regardless of where it's earned, is subject to Pennsylvania income tax.

- Military Pay Exemption: Pennsylvania offers a full exemption for military pay earned while serving on active duty outside of Pennsylvania. This is a significant benefit.

- Important: If you are stationed in Pennsylvania, your military pay is subject to Pennsylvania income tax.

- Example: You are a Pennsylvania resident stationed in California. Your military pay is exempt from Pennsylvania income tax.

- Filing Requirement: You must file a Pennsylvania income tax return (PA-40) and claim the military pay exemption.

Non-Resident Active Duty Military Stationed in Pennsylvania

If Pennsylvania is not your legal residence, but you are stationed there:

- Military Pay: Your military pay is not subject to Pennsylvania income tax due to the Servicemembers Civil Relief Act (SCRA).

- Non-Military Income: Any income you earn from Pennsylvania sources other than military pay (e.g., rental income, income from a civilian job) is subject to Pennsylvania income tax.

- Filing Requirement: If you have income from Pennsylvania sources beyond your military pay, you may need to file a Pennsylvania non-resident income tax return (PA-40NR).

Common Mistakes to Avoid

- Assuming Military Pay is Always Exempt: The "outside of Pennsylvania" clause is crucial for Pennsylvania residents.

- Incorrectly Claiming Residency: Ensure your documentation supports your claim of residency (or non-residency). This is especially important if you are claiming non-resident status.

- Failing to File When Necessary: Even if you believe you owe no taxes, file a return to avoid penalties.

- Ignoring Local Taxes: While the state provides exemptions, some local taxes (e.g., Earned Income Tax) may still apply depending on your situation. Consult with a tax professional to verify.

Resources for Military Tax Information

- Military Tax Services: The IRS provides free tax assistance to military personnel through Volunteer Income Tax Assistance (VITA) sites on military bases and at other locations.

- Pennsylvania Department of Revenue: Their website provides information on Pennsylvania taxes.

- Tax Professionals: Consider consulting a qualified tax advisor who is familiar with military tax issues.

Video: PA State Taxes: Military Guide! Avoid Costly Mistakes

PA State Taxes: Military Guide FAQs

This section addresses common questions about Pennsylvania state taxes for military members. We aim to provide clear and concise answers to help you avoid costly mistakes.

What are the residency rules for PA state taxes if I'm in the military?

Your residency for PA state tax purposes generally depends on where you were legally domiciled (permanent home) when you entered the military. If Pennsylvania was your home of record when you joined, you likely remain a Pennsylvania resident, even if stationed elsewhere.

Do active duty military pay state taxes in Pennsylvania?

Yes, active duty military pay state taxes in Pennsylvania if they are residents of Pennsylvania. However, there are some important exemptions. For example, active duty pay is exempt if you're stationed outside of Pennsylvania.

Are there any specific PA tax forms I should be aware of as a military member?

You should familiarize yourself with the PA-40, which is the Pennsylvania Income Tax Return. Also, understand the forms related to claiming any exemptions you qualify for, like the active duty pay exemption. The Pennsylvania Department of Revenue website has useful publications and resources.

What if my spouse is a civilian and we're stationed in Pennsylvania?

Your spouse’s income will likely be subject to Pennsylvania state income tax if they live and/or work in Pennsylvania. It's crucial to accurately report all income and withholdings on your PA-40 return. Consider consulting a tax professional for personalized advice.