PA Child Tax Credit: What It Means for Your Family

The Pennsylvania Department of Revenue manages various tax programs, including the Child and Dependent Care Enhancement Program. This program is crucial for many families in Pennsylvania. Eligibility for the program often relies on factors such as income and number of qualifying children. Understanding the pennsylvania child tax credit 2024 requires navigating guidelines set forth by the state legislature. Furthermore, tax preparation software can simplify the application process. Many residents are finding it difficult to navigate through the requirements of the pennsylvania child tax credit 2024 without assistance. Tax professionals, like Certified Public Accountants (CPAs), can provide advice and assistance to families seeking to understand and maximize their benefits under the pennsylvania child tax credit 2024.

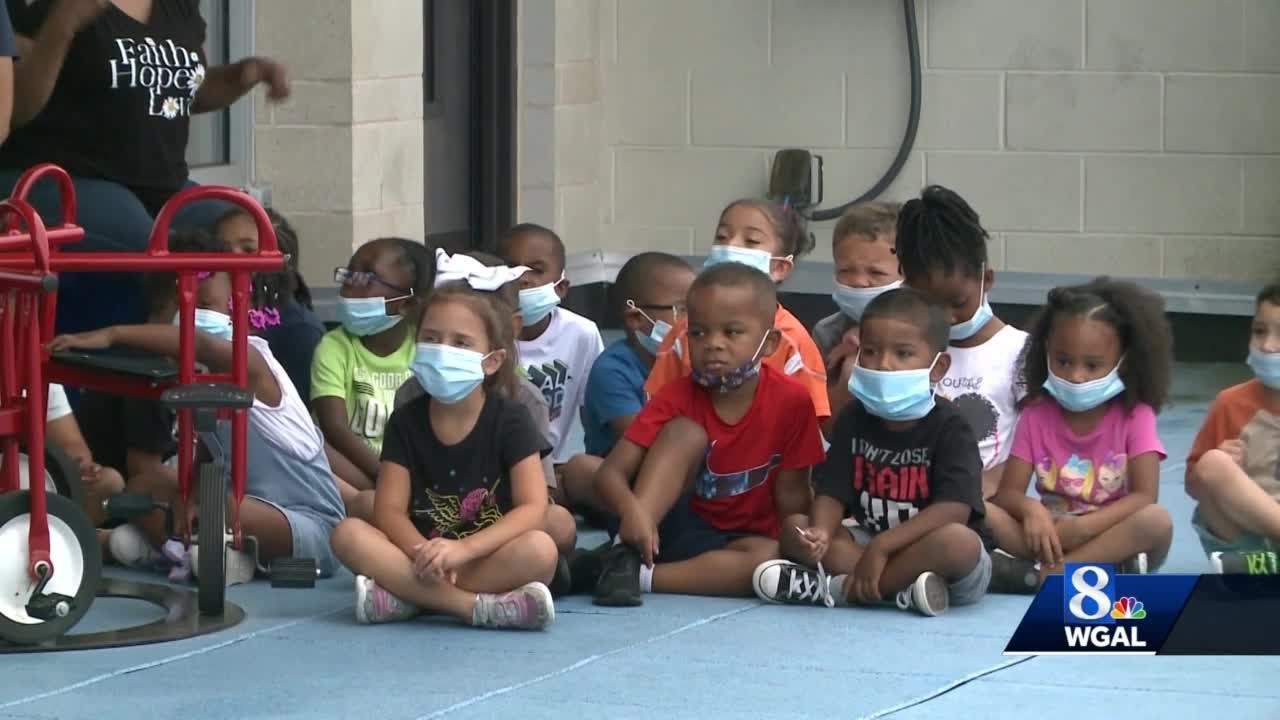

Image taken from the YouTube channel wgaltv , from the video titled Child care tax credit program will benefit working Pennsylvania families .

Understanding the Pennsylvania Child Tax Credit 2024: A Guide for Families

This guide breaks down the Pennsylvania Child Tax Credit, explaining who is eligible, how to claim it, and what it means for your family's finances.

What is the Pennsylvania Child Tax Credit?

The Pennsylvania Child Tax Credit is a state tax credit designed to help Pennsylvania families with the costs of raising children. The credit provides financial relief to qualifying families by reducing their state income tax liability. Think of it as money back in your pocket to help with expenses like childcare, clothing, and education. The details for Pennsylvania Child Tax Credit 2024 are vital for families planning their finances.

- This credit is different from the federal Child Tax Credit.

- The purpose is to alleviate the financial burden of raising children in Pennsylvania.

Eligibility Requirements for the Pennsylvania Child Tax Credit 2024

To be eligible for the Pennsylvania Child Tax Credit 2024, you must meet specific criteria. These primarily involve your income and the dependents you are claiming.

Income Limits

There are income limits to qualify for the credit. The exact thresholds vary depending on the number of children you are claiming. Keep in mind these are subject to change, so always refer to official sources (such as the PA Department of Revenue) for the most up-to-date figures.

- Families with higher incomes might not qualify.

- Income is generally based on your adjusted gross income (AGI).

Qualifying Child Requirements

The child you are claiming for the credit must also meet certain requirements, similar to those for the federal child tax credit.

- Age: The child must be under age 17 at the end of the tax year (December 31, 2024).

- Relationship: The child must be your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of them (for example, a grandchild, niece, or nephew).

- Residency: The child must live with you for more than half of the tax year.

- Dependent Status: You must claim the child as a dependent on your federal tax return.

- Citizenship: The child must be a U.S. citizen, U.S. national, or U.S. resident alien.

How to Claim the Pennsylvania Child Tax Credit

Claiming the Pennsylvania Child Tax Credit 2024 involves completing the necessary form and submitting it with your Pennsylvania state income tax return (PA-40).

Required Forms and Documentation

You'll likely need to complete a specific schedule or form to claim the credit. Check the Pennsylvania Department of Revenue website for the latest version of this form. You'll also need:

- Your Social Security number.

- Your child's Social Security number or Individual Taxpayer Identification Number (ITIN).

- Proof of your income (e.g., W-2 forms).

- Any other documentation requested on the official form.

Step-by-Step Instructions

- Download the Form: Obtain the appropriate form from the Pennsylvania Department of Revenue website.

- Gather Information: Collect all the necessary documents, including your income statements and your child's Social Security number.

- Complete the Form: Carefully fill out the form, following the instructions provided. Ensure all information is accurate and legible.

- Attach to PA-40: Include the completed form with your Pennsylvania income tax return (PA-40).

- File Your Return: File your Pennsylvania tax return by the filing deadline.

Understanding the Credit Amount for 2024

The exact amount of the Pennsylvania Child Tax Credit 2024 can vary and is often subject to legislative changes. It's essential to check the official guidelines for the specific tax year to determine the credit amount you are eligible for.

- The credit amount is often a fixed dollar amount per qualifying child.

- This amount may be adjusted annually based on state budget considerations.

- Consult the PA Department of Revenue website for the precise credit amount for 2024.

Where to Find Official Information and Updates

Always rely on official sources for the most current and accurate information about the Pennsylvania Child Tax Credit 2024.

Pennsylvania Department of Revenue Website

The Pennsylvania Department of Revenue website is the primary source for official information.

- Look for publications, forms, and instructions related to the child tax credit.

- Check for announcements or updates regarding eligibility requirements and credit amounts.

Tax Professionals

Consult with a qualified tax professional for personalized advice and assistance with claiming the credit. They can help you navigate the eligibility requirements and ensure you are maximizing your tax benefits.

Video: PA Child Tax Credit: What It Means for Your Family

PA Child Tax Credit: FAQs for Pennsylvania Families

Here are some frequently asked questions about the Pennsylvania Child Tax Credit to help you understand what it means for your family.

What is the PA Child Tax Credit?

The Pennsylvania Child Tax Credit is a new state tax credit designed to provide financial relief to eligible families with children. It helps offset the costs associated with raising children and improving economic stability for Pennsylvania households. The aim of the pennsylvania child tax credit 2024 is to support working families.

Who is eligible for the Pennsylvania Child Tax Credit?

Eligibility generally depends on income level and the number of qualifying children you have. Specific income thresholds and criteria will be determined by the Pennsylvania Department of Revenue. Check their official website for details regarding the pennsylvania child tax credit 2024 qualifications.

How do I claim the Pennsylvania Child Tax Credit?

The Pennsylvania Child Tax Credit will likely be claimed when you file your state income tax return. Details regarding the process for claiming the pennsylvania child tax credit 2024, including any necessary forms or documentation, will be released by the Pennsylvania Department of Revenue.

When will I receive the Pennsylvania Child Tax Credit?

The timing of when you receive the credit will depend on when you file your tax return and the processing time of the Pennsylvania Department of Revenue. Be sure to file your taxes accurately and on time to ensure timely receipt of the pennsylvania child tax credit 2024.