PA Corp Tax Rate: Is Your Business Paying Too Much?

Pennsylvania's business landscape necessitates a deep understanding of the Pennsylvania Corporate Tax Rate. The Pennsylvania Department of Revenue establishes and enforces tax regulations, impacting businesses' profitability. Strategic tax planning, often involving CPA firms specializing in Pennsylvania corporate tax, is crucial to minimize tax liabilities. Therefore, analysis of factors affecting the pennsylvania corporate tax rate is essential in optimizing your company's performance. Understanding how economic conditions can sway the pennsylvania corporate tax rate is essential for budgeting.

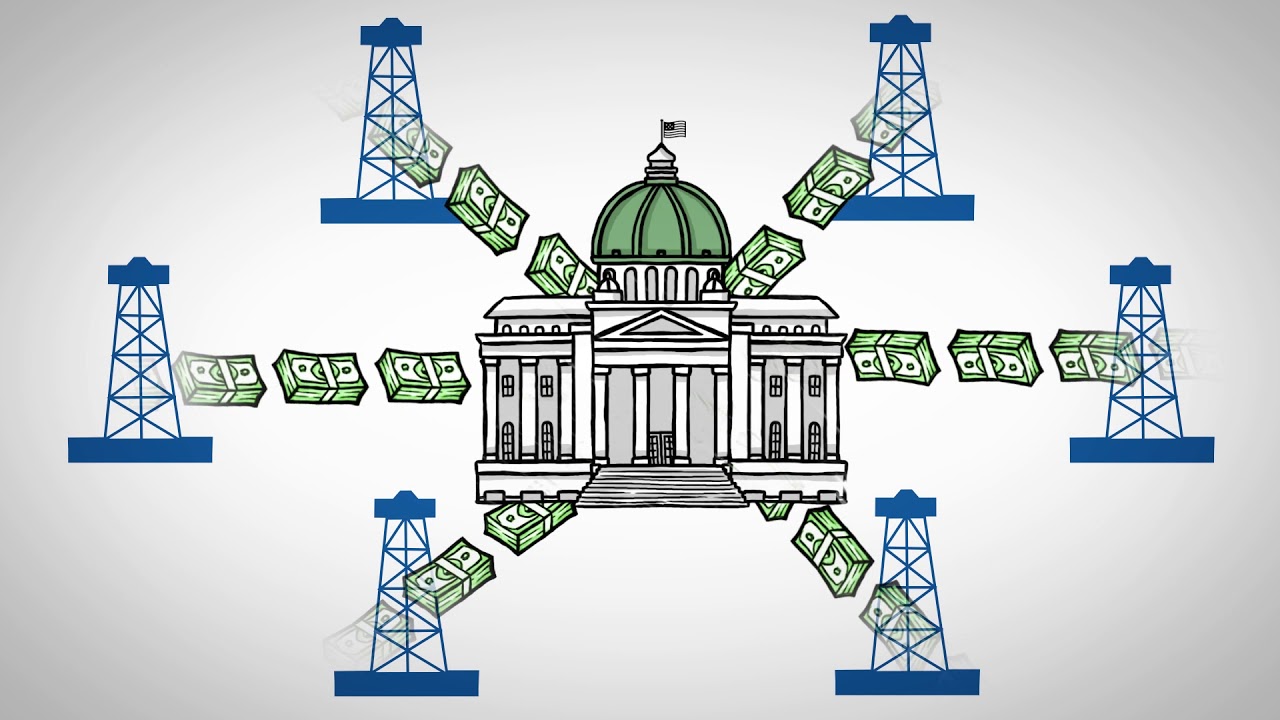

Image taken from the YouTube channel Citizens to Protect PA Jobs , from the video titled The Truth About PA's Severance Tax .

Pennsylvania Corporate Tax Rate: Understanding If Your Business Is Overpaying

This guide breaks down the Pennsylvania Corporate Net Income Tax (CNIT) and helps businesses understand whether they are paying the correct amount. We'll explore the rate itself, what income is subject to the tax, available deductions, and strategies for minimizing your tax burden, always with a focus on staying compliant.

Understanding the Pennsylvania Corporate Net Income Tax (CNIT)

The CNIT is a tax levied on the taxable income of corporations operating in Pennsylvania. Figuring out your correct liability requires understanding the applicable rate and what constitutes taxable income.

What is the Pennsylvania Corporate Tax Rate?

The pennsylvania corporate tax rate has undergone significant changes in recent years. Understanding the current rate, and its recent history, is essential for accurate tax planning. As of 2023, the Pennsylvania CNIT rate is 8.99%. This rate is applied to a corporation's taxable net income apportioned to Pennsylvania. It is important to check for any updates to this rate annually as changes may occur.

Historical Pennsylvania Corporate Tax Rate Trends

| Year(s) | Rate |

|---|---|

| Before 2014 | 9.99% |

| 2014-2022 | 9.99% |

| 2023 Onwards | 8.99% |

This table illustrates that the pennsylvania corporate tax rate has remained constant for almost a decade, and was lowered recently. Tracking these changes is crucial for historical tax analysis and projections.

Determining Taxable Income in Pennsylvania

Calculating your CNIT liability starts with understanding what constitutes taxable income in Pennsylvania. This involves starting with your federal taxable income and then making Pennsylvania-specific adjustments.

Calculating Pennsylvania Taxable Income

The general process is as follows:

- Start with Federal Taxable Income: Begin with the corporation's taxable income as calculated on the federal corporate income tax return (Form 1120).

- Add Back Certain Deductions: Pennsylvania requires adding back certain deductions claimed at the federal level. Common add-backs include state taxes and net operating loss (NOL) carryovers exceeding specific limitations.

- Subtract Certain Deductions: Pennsylvania also allows for certain deductions that are not available at the federal level.

- Apportion Income: For corporations operating in multiple states, income is apportioned to Pennsylvania based on a formula that considers factors like sales, property, and payroll. The apportionment formula used is generally a single-sales factor apportionment. This means the amount of income apportioned to Pennsylvania is based solely on the percentage of the corporation's sales that are attributable to Pennsylvania.

Specific Add-Backs and Deductions

- Add-Backs: Examples include:

- State and Local Taxes

- Related Party Expenses (subject to certain exceptions)

- Deductions: Pennsylvania allows some deductions specific to the state. Consulting with a tax professional is highly recommended.

Understanding Apportionment for Multi-State Businesses

Apportionment is critical for corporations that operate in multiple states, and has a significant impact on the amount of income subject to the pennsylvania corporate tax rate.

Single-Sales Factor Apportionment

Pennsylvania utilizes a single-sales factor apportionment formula. This means that only the percentage of a company's sales within Pennsylvania is used to determine the portion of income subject to the CNIT.

Impact of Sales Location

Understanding where your sales are sourced is essential. Generally, sales of tangible personal property are sourced to the location where the goods are delivered. Sales of services are generally sourced to where the customer receives the benefit of the service. This sourcing determination is crucial for calculating the sales factor.

Strategies for Minimizing Your Pennsylvania Corporate Tax Burden

Several strategies can help businesses minimize their Pennsylvania CNIT liability, while staying compliant with all regulations.

Maximizing Deductions

Ensure you are taking all eligible deductions allowed under Pennsylvania law. This requires careful review of your business activities and expenses.

Strategic Tax Planning

- Consider the impact of business structure. Different business structures (S-corp, C-corp, etc.) have different tax implications.

- Timing of Income and Expenses: Carefully plan the timing of income and expenses to optimize your tax position.

- Monitor legislative changes: Keep up-to-date on any changes to Pennsylvania tax laws that may impact your business.

Seeking Professional Advice

Consulting with a qualified tax professional who specializes in Pennsylvania corporate tax is strongly recommended. They can provide tailored advice based on your specific circumstances and ensure compliance with all applicable laws and regulations. This is particularly vital if you believe your business has been overpaying, or is unsure about the correct application of the pennsylvania corporate tax rate.

Video: PA Corp Tax Rate: Is Your Business Paying Too Much?

PA Corp Tax Rate: Frequently Asked Questions

Understanding Pennsylvania's corporate tax system can be tricky. Here are some common questions to help you determine if your business is paying the correct amount.

What is the current Pennsylvania corporate tax rate?

As of [insert current date], the pennsylvania corporate tax rate is [insert current rate, e.g., 8.99%]. This rate applies to taxable income for most businesses operating as corporations in the state.

What types of businesses are subject to the Pennsylvania corporate tax rate?

The Pennsylvania corporate tax rate primarily applies to C corporations. S corporations typically pass their income through to their owners, who then report it on their individual income tax returns, but there may be exceptions and filing requirements. Consult with a tax professional for specific guidance.

Are there any deductions or credits that can lower my Pennsylvania corporate tax burden?

Yes, Pennsylvania offers various deductions and credits that can reduce your overall tax liability. Common examples include deductions for business expenses and tax credits for research and development activities or job creation. Review the Pennsylvania Department of Revenue website or consult with a qualified tax advisor to see which ones apply to your business.

Where can I find more information about Pennsylvania corporate tax requirements?

The Pennsylvania Department of Revenue website is the primary source for all information about state taxes, including the pennsylvania corporate tax rate, regulations, and forms. You can also consult with a qualified tax professional for personalized advice and assistance with tax planning and compliance.