PA Payroll Calculator: Avoid Costly Mistakes? Find Out!

Pennsylvania employers face complex payroll obligations; accurate pennsylvania payroll calculator use is crucial. The Pennsylvania Department of Revenue mandates specific tax withholding procedures, requiring precise calculations. Selecting appropriate payroll software significantly impacts compliance and efficiency for businesses of all sizes in the state. Proper employee classification, addressing independent contractor versus employee status, is vital to prevent misclassification penalties when using a pennsylvania payroll calculator. Leveraging resources such as the IRS guidelines further ensures businesses are equipped to handle their pennsylvania payroll calculator processes accurately and avoid potentially costly errors.

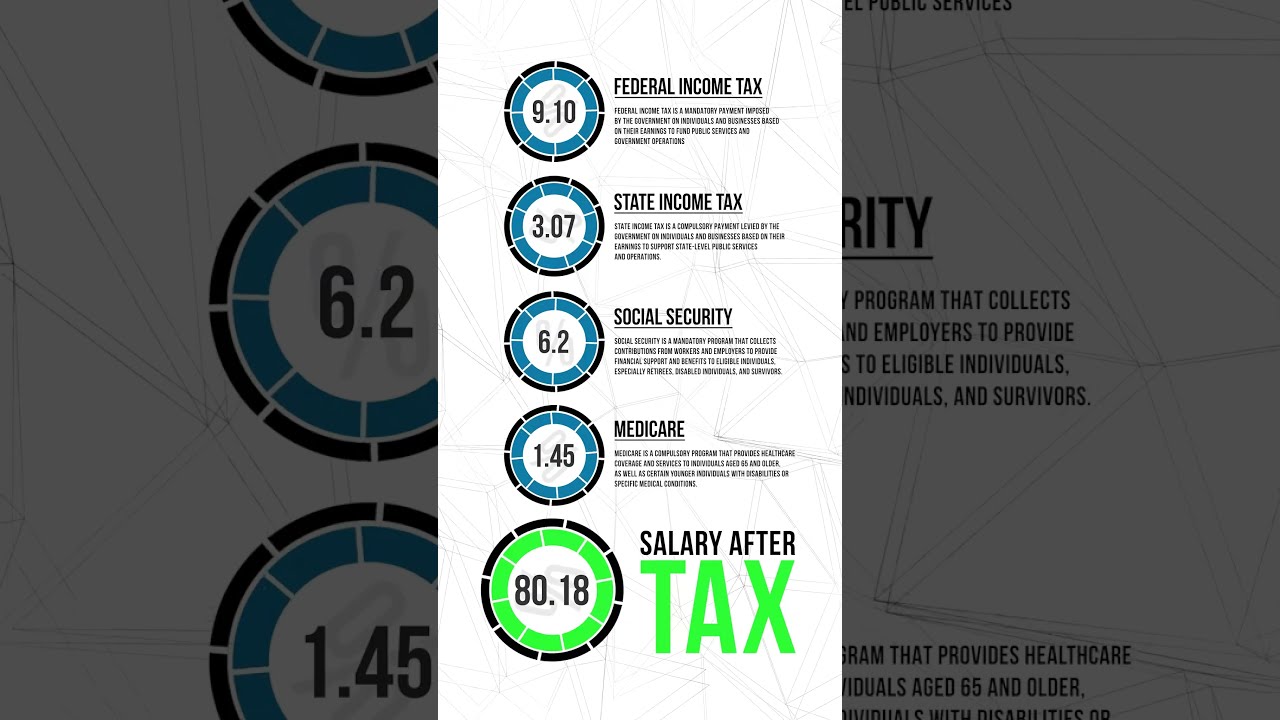

Image taken from the YouTube channel iCalculator , from the video titled $60,000 Salary After Tax in Pennsylvania: Detailed Annual Tax Breakdown | 2023 .

Crafting the Ideal Article Layout: Pennsylvania Payroll Calculator - Avoid Costly Mistakes? Find Out!

This document outlines the optimal structure for an informative article targeting individuals seeking clarity on Pennsylvania payroll calculations, specifically utilizing a "pennsylvania payroll calculator." The goal is to present information in a clear, accessible, and actionable manner to help users avoid costly payroll errors.

Understanding the Pennsylvania Payroll Landscape

This section serves as the foundational overview, explaining why understanding Pennsylvania payroll is crucial.

Why is Accurate Pennsylvania Payroll Important?

- Legal Compliance: Pennsylvania has specific laws and regulations regarding payroll, including tax withholdings, minimum wage, and overtime. Non-compliance can result in significant penalties.

- Employee Satisfaction: Accurate and timely paychecks are vital for employee morale and retention. Errors can lead to distrust and potential legal action.

- Financial Stability: Consistent payroll management ensures predictable cash flow and accurate financial reporting.

Key Factors Influencing Pennsylvania Payroll

- Federal and State Taxes: Explain the interplay between federal and Pennsylvania state income tax, Social Security, Medicare, and unemployment taxes.

- Local Taxes: Highlight the importance of understanding local earned income tax (EIT) and local services tax (LST) variations across different municipalities in Pennsylvania.

- Deductions and Withholdings: Cover common deductions like health insurance premiums, retirement contributions, and garnishments.

Introducing the Pennsylvania Payroll Calculator

This section introduces the core subject of the article: the "pennsylvania payroll calculator."

What is a Pennsylvania Payroll Calculator?

- Definition: Clearly define what a payroll calculator is and its purpose in simplifying payroll calculations. Explain it as a tool that automates the process of calculating gross pay, taxes, and net pay.

-

Benefits: List the advantages of using a payroll calculator.

- Accuracy: Minimizes the risk of manual calculation errors.

- Time Savings: Automates the calculation process, freeing up time for other tasks.

- Compliance: Some calculators are designed to stay up-to-date with the latest tax laws and regulations.

Types of Pennsylvania Payroll Calculators

- Free Online Calculators: Discuss the advantages and disadvantages of free, publicly available calculators. These are often simpler but may lack advanced features or guaranteed accuracy.

- Subscription-Based Calculators: Explain the benefits of paid subscription services, which often include more comprehensive features, dedicated support, and automatic updates.

- Payroll Software Integration: Describe how some payroll software programs incorporate calculator functionality and integrate with accounting systems.

Using a Pennsylvania Payroll Calculator Effectively

This section provides a step-by-step guide on how to use a payroll calculator and interpret the results.

Gathering the Necessary Information

List the essential data points required for accurate calculations.

- Employee Information: Name, address, Social Security number, filing status (single, married, etc.), and number of dependents.

- Pay Rate: Hourly wage or salary.

- Hours Worked: Total hours worked during the pay period (including overtime).

- Deductions: Pre-tax and post-tax deductions (e.g., health insurance, retirement contributions).

- Local Tax Information: Residence address for EIT and LST calculation.

Step-by-Step Calculation Process (Example)

Present a simplified example using a hypothetical employee.

| Step | Description | Example Value |

|---|---|---|

| 1 | Calculate Gross Pay | $20/hour * 40 hours = $800 |

| 2 | Federal Income Tax Withholding (using W-4 and tax tables) | $50 |

| 3 | Social Security Tax (6.2% of gross pay) | $49.60 |

| 4 | Medicare Tax (1.45% of gross pay) | $11.60 |

| 5 | Pennsylvania State Income Tax Withholding (3.07% of gross pay) | $24.56 |

| 6 | Local Earned Income Tax (EIT) Withholding (Example: 1% of gross pay) | $8 |

| 7 | Net Pay (Gross Pay - All Taxes and Deductions) | (Calculate based on all values) |

Interpreting the Results

- Understanding Each Line Item: Explain the meaning of each line item in the calculator output, such as gross pay, federal income tax, state income tax, Social Security tax, Medicare tax, and net pay.

- Validating the Accuracy: Suggest methods for verifying the calculator's accuracy, such as comparing the results to previous pay stubs or consulting with a payroll professional.

Avoiding Common Pennsylvania Payroll Mistakes

This section highlights potential errors and provides tips for prevention.

Identifying Potential Pitfalls

- Misclassifying Employees as Independent Contractors: Explain the differences between employees and independent contractors and the consequences of misclassification.

- Incorrectly Calculating Overtime Pay: Review the overtime rules for Pennsylvania and ensure proper calculation of overtime wages.

- Failing to Accurately Withhold Local Taxes: Emphasize the importance of determining the correct local taxes based on employee residency.

- Not Staying Up-to-Date with Tax Law Changes: Highlight the need to monitor changes in federal, state, and local tax laws that affect payroll.

Best Practices for Error Prevention

- Regularly Review Payroll Processes: Conduct periodic audits of payroll processes to identify and correct errors.

- Utilize Reputable Payroll Resources: Consult with payroll professionals, tax advisors, or use reliable payroll software.

- Provide Employee Training: Train employees on proper timekeeping procedures and reporting requirements.

- Maintain Accurate Records: Keep detailed records of all payroll transactions, including employee information, pay rates, hours worked, and tax withholdings.

Resources for Pennsylvania Payroll

This section provides helpful links and resources for further information.

Government Agencies

- Pennsylvania Department of Revenue: Link to the PA Department of Revenue website for information on state income tax and other taxes.

- Internal Revenue Service (IRS): Link to the IRS website for information on federal payroll taxes.

Professional Organizations

- Society for Human Resource Management (SHRM): Link to SHRM for HR-related resources and information.

- American Payroll Association (APA): Link to APA for payroll-specific resources and training.

Useful Tools

- Links to reputable Pennsylvania payroll calculators (both free and paid options). Be sure to clearly state any affiliation or lack thereof.

Video: PA Payroll Calculator: Avoid Costly Mistakes? Find Out!

Pennsylvania Payroll Calculator FAQs

These frequently asked questions will help you better understand Pennsylvania payroll and how a payroll calculator can help.

Why is it important to use a Pennsylvania payroll calculator?

Using a Pennsylvania payroll calculator helps ensure accurate payroll calculations, including state and local taxes. This minimizes the risk of costly errors, penalties, and audits from state agencies. Calculating payroll manually in Pennsylvania can be complex due to varying local taxes.

What kind of errors can a Pennsylvania payroll calculator help me avoid?

A Pennsylvania payroll calculator significantly reduces errors related to tax withholding, especially local earned income and local services taxes. It also helps prevent mistakes in calculating overtime pay, deductions, and employer contributions for benefits. Incorrect calculations can result in substantial fines and legal issues.

What information do I need to use a Pennsylvania payroll calculator?

You'll need each employee's gross wages, Pennsylvania residency information (for local tax determination), federal and state withholding elections (W-4 and REV-419), and any applicable deductions (e.g., health insurance, retirement contributions). Make sure all information is up-to-date for accurate Pennsylvania payroll processing.

Where can I find an accurate Pennsylvania payroll calculator?

Many payroll software providers offer integrated Pennsylvania payroll calculator tools. Look for reputable providers that automatically update tax rates and regulations. Online calculators are also available, but ensure they are regularly maintained and accurately reflect current Pennsylvania tax laws to avoid penalties.

Hopefully, this gave you a clearer picture of navigating the complexities of the pennsylvania payroll calculator! Good luck keeping your payroll accurate, and don't hesitate to do some extra research!