Pool Loans Pennsylvania: Get Approved Fast! Here's How

Obtaining pool loans Pennsylvania represents a significant financial decision. The application process often involves considering your credit score, which is a critical factor for approval. Many homeowners explore options through local Pennsylvania banks, known for offering various loan products. These institutions frequently require detailed financial documentation. Understanding the loan terms, specifically interest rates and repayment schedules, is essential for budgeting and long-term financial planning. If you're dreaming of a backyard oasis, knowing the intricacies of pool loans Pennsylvania is your first step!

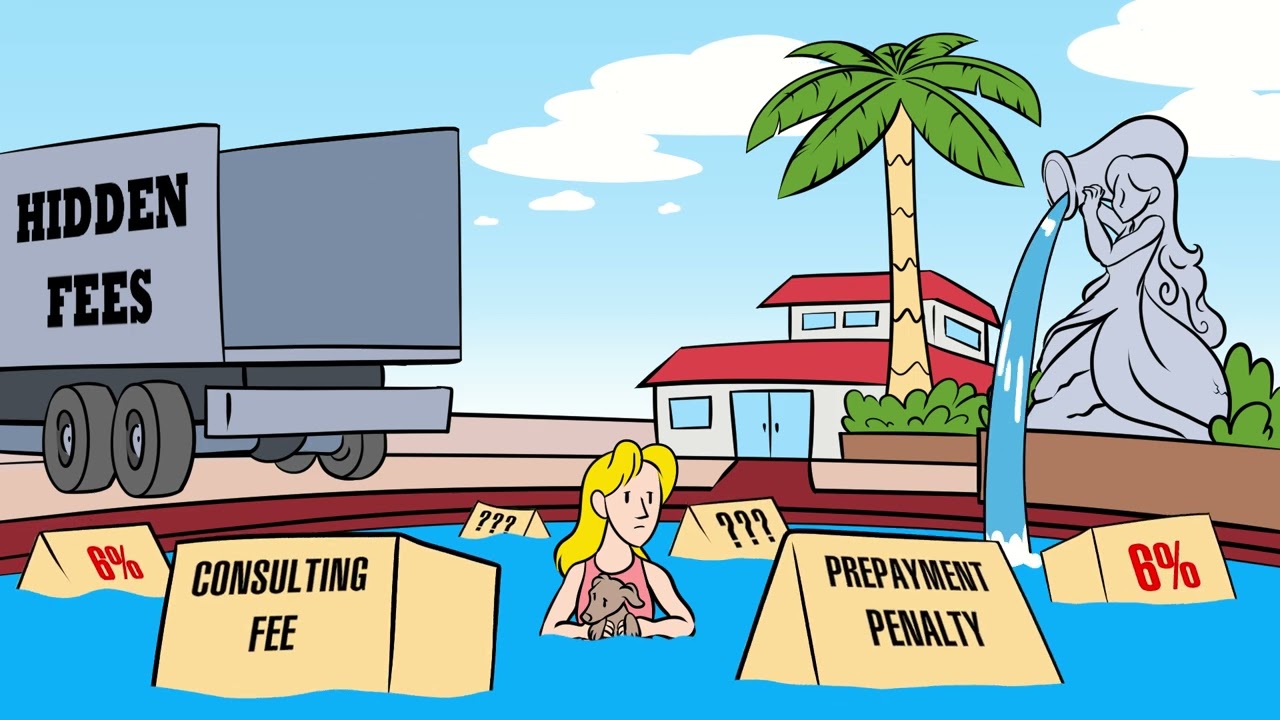

Image taken from the YouTube channel Lyon Financial , from the video titled Swimming Pool Loans with no Hidden Fees .

Crafting the Ideal Article Layout: "Pool Loans Pennsylvania: Get Approved Fast! Here's How"

This guide outlines the optimal article layout for "Pool Loans Pennsylvania: Get Approved Fast! Here's How," ensuring clarity, reader engagement, and SEO effectiveness focused around the keyword "pool loans pennsylvania." The objective is to provide a comprehensive and user-friendly resource.

1. Introduction: Hooking the Reader

The introduction is crucial for capturing interest and setting expectations. It should directly address the reader's need for a pool loan in Pennsylvania and promise actionable information.

- Start with a relatable scenario: "Dreaming of a backyard oasis in Pennsylvania? A pool is a fantastic addition, but financing can be a hurdle."

- Clearly state the article's purpose: "This guide will walk you through the process of securing pool loans in Pennsylvania, offering tips to get approved quickly."

- Incorporate the main keyword naturally: "Finding the right pool loans in Pennsylvania can be easier than you think. We'll show you how."

- Briefly outline the article's structure: "We'll cover eligibility requirements, types of loans available, application tips, and alternative funding options."

2. Understanding Pool Loans in Pennsylvania

This section defines what pool loans are and how they work in the context of Pennsylvania.

2.1 What are Pool Loans?

- Explain that pool loans are specifically designed to finance the construction or installation of a swimming pool.

- Differentiate between secured (home equity-based) and unsecured pool loans.

- Emphasize that these are installment loans, repaid over a set period with interest.

2.2 Pool Loan Options in Pennsylvania

- Unsecured Personal Loans: Discuss the pros and cons of using personal loans for pool financing. Mention potentially higher interest rates but faster approval times.

- Home Equity Loans (HEL): Explain how these loans leverage existing home equity. Highlight the potential for lower interest rates but also the risk of foreclosure.

- Home Equity Lines of Credit (HELOC): Similar to HEL, but with a revolving credit line. Discuss the flexibility of HELOCs and their variable interest rates.

- Pool Builder Financing: Some pool builders offer financing options directly. Discuss the potential benefits (convenience) and drawbacks (potentially higher costs).

2.3 Factors Affecting Interest Rates

Explain the factors that lenders consider when determining interest rates for pool loans in Pennsylvania. This will help readers understand their borrowing power.

- Credit Score: Emphasize the importance of a good credit score (e.g., 700 or higher).

- Debt-to-Income Ratio (DTI): Explain how DTI is calculated and its impact on loan approval and interest rates.

- Loan Amount: Larger loan amounts may attract higher interest rates.

- Loan Term: Longer loan terms typically result in lower monthly payments but higher overall interest costs.

- Collateral (for secured loans): The value of the home securing the loan impacts the interest rate.

3. Eligibility Requirements for Pool Loans

This section clarifies the criteria lenders use to assess loan applications.

3.1 Credit Score Requirements

- Provide a general range of acceptable credit scores (e.g., 650+).

- Explain that higher credit scores lead to better loan terms.

- Suggest resources for checking and improving credit scores.

3.2 Income and Employment Verification

- Outline the documentation required to verify income (e.g., pay stubs, tax returns).

- Explain how lenders assess employment stability.

- Address how self-employed individuals can verify their income.

3.3 Debt-to-Income (DTI) Ratio

- Provide a generally acceptable DTI ratio (e.g., below 43%).

- Explain how lenders calculate DTI.

- Offer tips for lowering DTI.

3.4 Home Equity (for Secured Loans)

- Explain the loan-to-value (LTV) ratio.

- Clarify how lenders assess home value.

- Highlight the importance of a recent appraisal.

4. Steps to Get Approved for a Pool Loan Fast

This section provides actionable advice for a smooth application process.

- Check Your Credit Score: Before applying, know where you stand.

- Gather Your Documents: Prepare pay stubs, tax returns, bank statements, and identification.

- Shop Around for Lenders: Compare offers from multiple lenders.

- Pre-Qualify for a Loan: Get an estimate of how much you can borrow without impacting your credit score.

- Submit a Complete Application: Ensure all information is accurate and complete.

- Respond Promptly to Lender Requests: Address any questions or requests from the lender quickly.

5. Finding the Best Pool Loan Rates in Pennsylvania

This section details how to effectively search for competitive rates.

- Utilize Online Comparison Tools: Mention reputable websites for comparing loan rates.

- Contact Local Banks and Credit Unions: Explore options from local lenders.

- Compare APR (Annual Percentage Rate): Emphasize that APR is the most accurate measure of loan cost.

- Read the Fine Print: Understand all fees and terms before accepting a loan offer.

6. Alternative Funding Options

This section explores possibilities outside of traditional pool loans.

- Savings: Using personal savings to finance the pool.

- 0% Credit Card Offers: For smaller pool projects, consider using a 0% introductory APR credit card.

- Borrowing from Family or Friends: This could provide more flexible repayment terms.

- Grants and Rebates: Explore any available state or local programs for pool construction or energy efficiency.

7. Choosing the Right Pool Loan for You: A Summary Table

A table summarizing the different loan types, their advantages, and disadvantages will help readers make an informed decision.

| Loan Type | Advantages | Disadvantages |

|---|---|---|

| Unsecured Personal Loan | Fast approval, no collateral needed | Higher interest rates, lower loan amounts |

| Home Equity Loan | Lower interest rates, higher loan amounts | Risk of foreclosure, requires home equity |

| HELOC | Flexible credit line, variable rates | Variable interest rates, risk of foreclosure |

| Pool Builder Financing | Convenient, one-stop shopping | Potentially higher costs |

Video: Pool Loans Pennsylvania: Get Approved Fast! Here's How

Pool Loans Pennsylvania: FAQs

This section addresses common questions about securing pool loans in Pennsylvania and getting approved quickly.

What credit score do I need to qualify for a pool loan in Pennsylvania?

While there's no single "magic number," a credit score of 680 or higher generally increases your chances of approval for pool loans Pennsylvania. Lower scores may still be considered, but expect higher interest rates.

How long does it take to get approved for a pool loan in Pennsylvania?

Approval times vary depending on the lender and your financial situation. However, many lenders specializing in pool loans Pennsylvania offer fast approvals, sometimes within 24-48 hours.

What types of pools can be financed with a pool loan in Pennsylvania?

Most pool loans can be used to finance inground, above-ground, and even semi-inground pools. Be sure to check with your lender to confirm their specific pool financing options within Pennsylvania.

What documents will I need to apply for pool loans in Pennsylvania?

Typically, you'll need to provide proof of income (pay stubs, tax returns), identification, and information about the pool you plan to build. Lenders offering pool loans Pennsylvania may also require a quote from your pool contractor.